PET PARENTHOOD

As inflation tightens its grip on American households, many pet owners are facing a heart-wrenching dilemma: how to care for their beloved pets without compromising their own well-being. A new national survey commissioned by MetLife Pet Insurance highlights the growing crisis of pet poverty — a reality where financial struggles make it difficult to provide even basic care for companion animals. The findings shine a light on the emotional and economic sacrifices pet parents make every day to keep their furry family members healthy and safe.

Key Takeaways

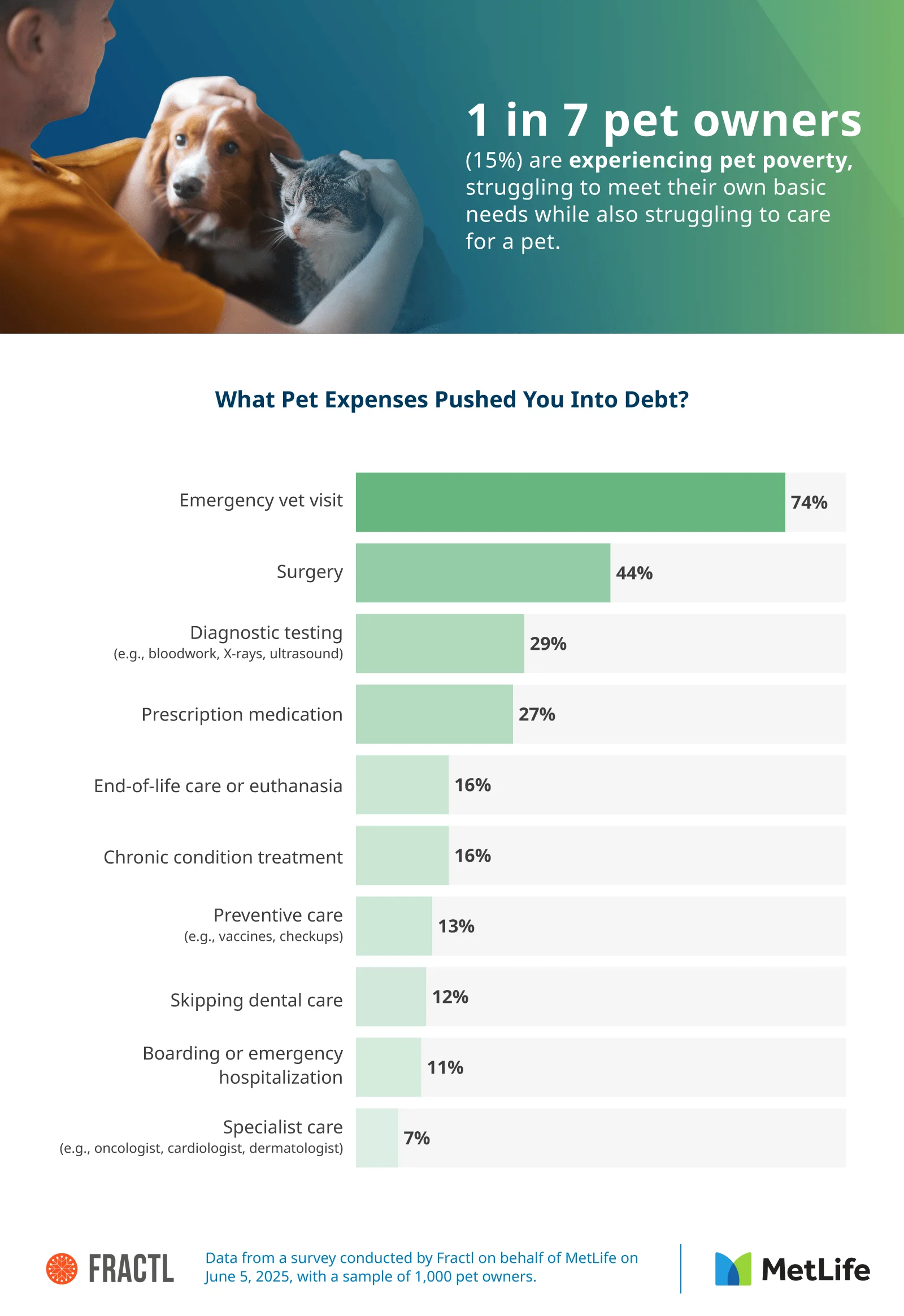

- 1 in 7 pet owners (15%) are experiencing pet poverty.

- Over 1 in 5 pet owners (22%) currently carry over $2,000 in pet-related debt.

- Nearly 2 in 5 pet owners (39%) have gone into debt to pay for medical care, carrying an average balance of $450.

- Gen Z pet owners are most likely to sacrifice their mental well-being: 45% skip hobbies or self-care, and 36% take on extra work to afford their pets' needs.

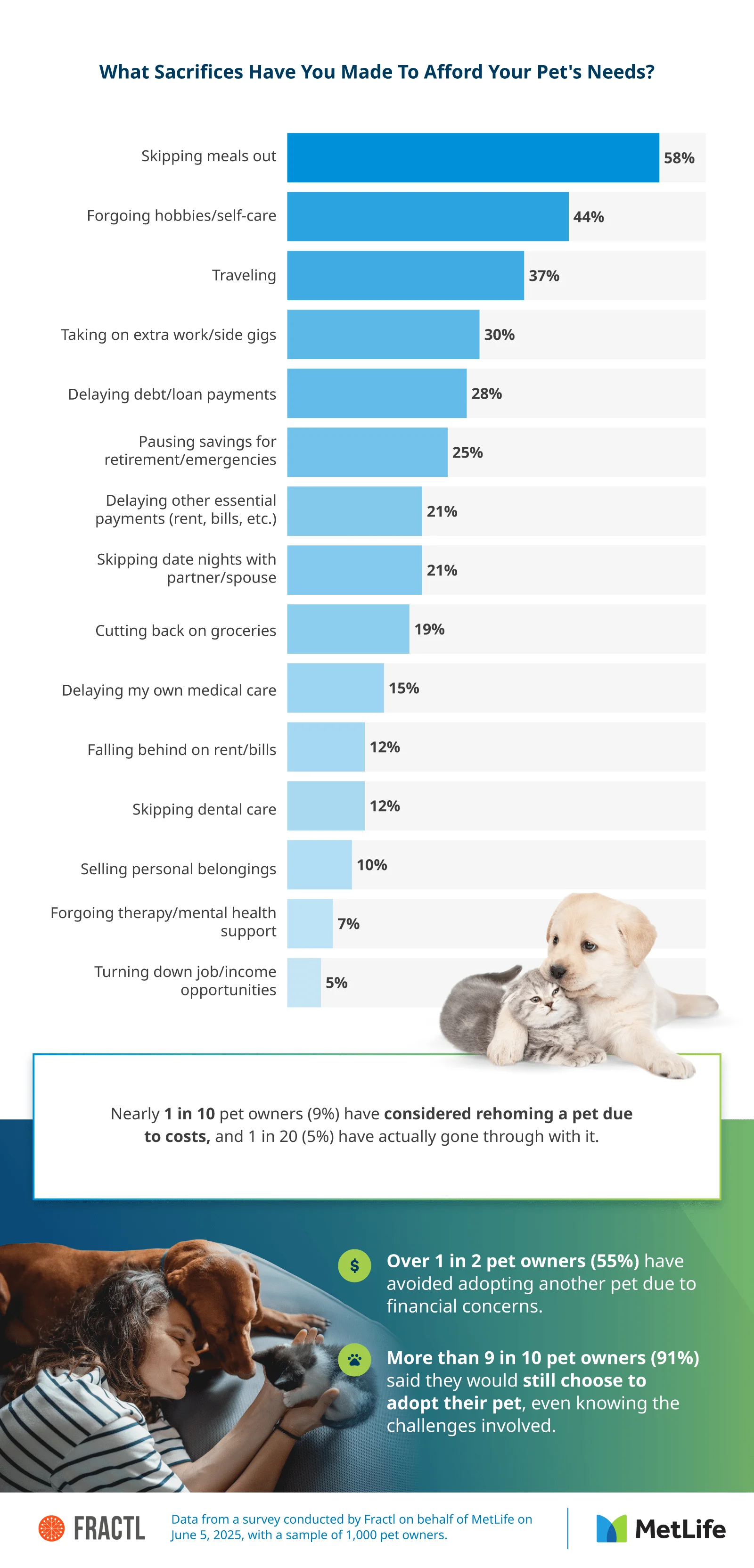

- More than 1 in 2 pet owners (58%) are skipping meals out to afford their pet's needs.

- Over half of pet owners (55%) have avoided adopting another pet due to financial concerns.

- Nearly 1 in 10 pet owners (9%) have considered rehoming a pet due to costs, and 1 in 20 (5%) have actually gone through with it.

Financial Strain Is Driving Pet Owners Into Debt

Many pet owners are turning to debt to cover rising veterinary costs, highlighting just how financially unmanageable pet care has become for some families.1

Currently, 15% of pet owners said they're experiencing pet poverty. This means that they're struggling to afford to pay for both their basic needs and pet care. Gen X and Gen Z pet owners were the most likely to be experiencing pet poverty (17% each), followed by millennials (14%) and baby boomers (11%).

Nearly 2 in 5 pet owners (39%) said they've gone into debt to cover medical expenses for their pets, with an average debt balance of $450. For 22% of these owners, the debt exceeds $2,000. Gen X pet owners are the most affected, with 46% having taken on pet-related debt, followed by baby boomers (42%), millennials (38%), and Gen Z (30%). Emergency vet visits were the top expense pushing pet owners into debt, cited by 74% of respondents.2 Surgery was next at 44%, and then diagnostic testing at 29%.

When unexpected bills arose, most pet owners (76%) relied on credit cards, while others borrowed from friends and family or turned to crowdfunding. Unfortunately, 34% of pet owners felt ashamed or embarrassed to ask for help paying for their pet's care.

Top Sources of Pet-Related Debt

Cause of Pet-Related Debt |

Average Debt |

Specialist care (e.g., oncologist, etc.) |

$1,440 |

Boarding or emergency hospitalization |

$1,300 |

Preventive care (e.g., vaccines, checkups) |

$1,130 |

Chronic condition treatment |

$1,130 |

Prescription medication |

$1,110 |

Diagnostic testing (e.g., bloodwork, X-rays) |

$1,110 |

Surgery |

$1,070 |

End-of-life care or euthanasia |

$940 |

Emergency vet visit |

$930 |

Skipping dental care |

$580 |

The Emotional and Everyday Costs of Pet Ownership

Financial stress tightens budgets and affects how people live, work, and care for themselves. From skipping meals to turning down life opportunities, the emotional and practical toll of pet parenting is significant.

More than half of pet owners (58%) reported skipping meals out to afford pet care, while 44% gave up hobbies or self-care. Many are also working more to make ends meet. Thirty percent have taken on side gigs, and 28% have delayed paying off loans or debts. These choices can also affect personal health, with 15% delaying medical care and 7% skipping therapy or other mental health support.

Generational patterns reveal unique challenges by age group. Here are some of the top ways in which each generation sacrifices for their pets:

Baby boomers: Skipping meals out (69%) and delaying debt payments (31%)

Gen X: Working extra hours (23%) and cutting back on groceries (22%)

Millennials: Taking on side gigs (39%) and pausing long-term savings (27%)3

Gen Z: Skipping hobbies/self-care (45%) and working additional jobs (36%)

The impact of pet ownership also affects major life choices. One in three pet owners (35%) said they have declined social invitations or avoided being away from home because of their pets. Nearly 1 in 4 (23%) missed work or took unpaid time off, and 17% turned down travel or relocation opportunities. Others reported staying in unfulfilling jobs (8%) or avoiding romantic relationships (5%) due to the responsibilities of pet care.

Because of the expense, 9% of pet owners have thought about rehoming a pet, while 5% have already done so. More than half (55%) said they've avoided adopting another pet due to financial concerns.

Despite challenges, the emotional rewards of pet ownership are clear. The majority of pet parents (86%) said their pet supports their mental health. While 27% said the financial stress has worsened their mental well-being, 63% said it has had no impact. Encouragingly, 49% said their pet supports them without being a financial burden.

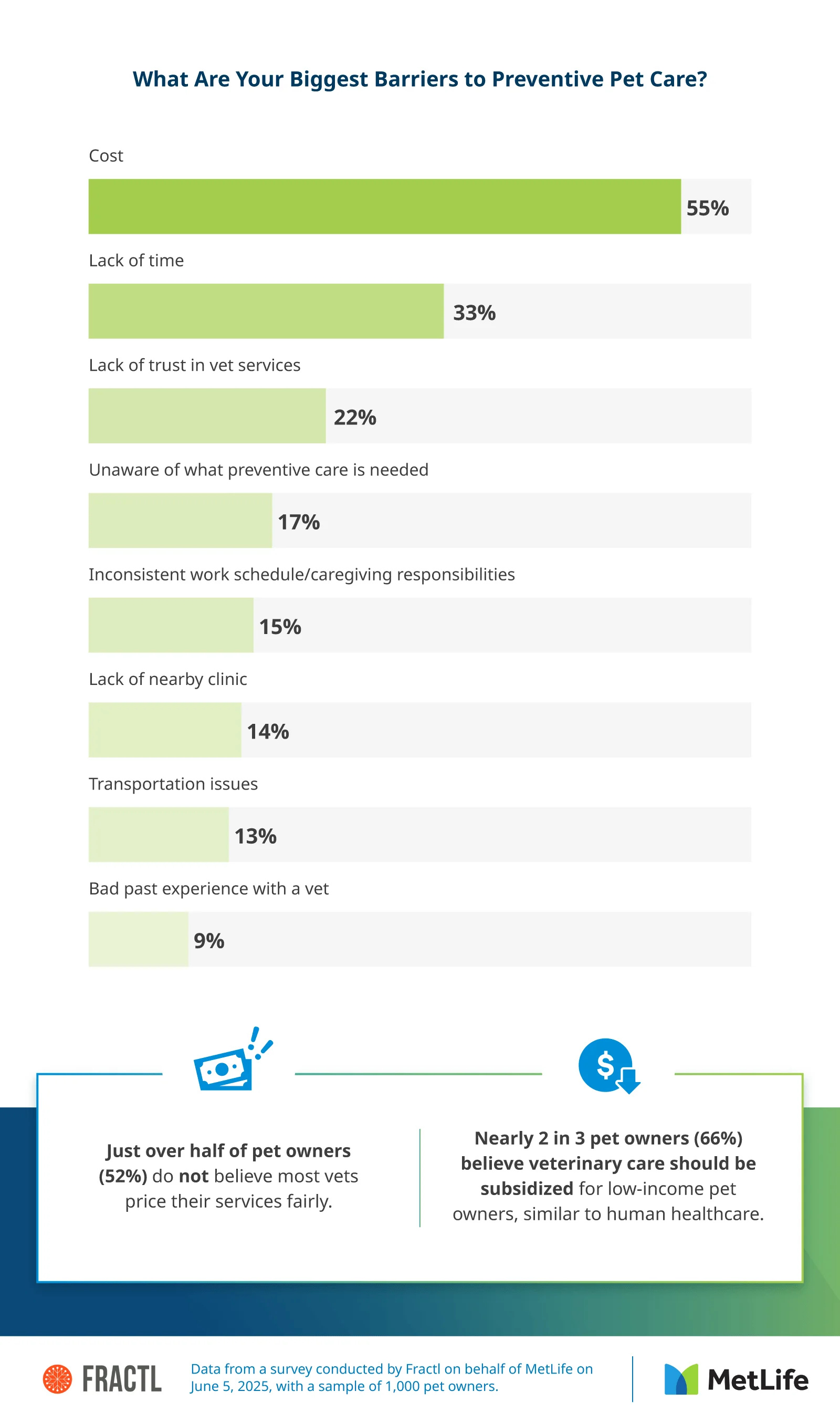

Barriers to Vet Care

Barriers to vet care prevent many families, especially those with limited income4, from accessing preventive services for their pets.

Just over half of pet owners (52%) believed vets don't price their services fairly, and 66% agreed that vet care should be subsidized for low-income families. While millennials and Gen Z were the most likely to have pet insurance (21% each), the majority remained uninsured. Only 15% of Gen X pet owners and 6% of baby boomers had coverage.

Among those without pet insurance, the top reasons included cost (28%), lack of recommendation from a vet (23%), and confusion about how it works (19%). Some had negative past experiences (17%) or didn't even know it was available (11%).

Conclusion: The Real Cost of Pet Love

This research shows the depth of sacrifice many pet owners make to care for their animals, from taking on debt to skipping meals and delaying personal needs. Despite the financial and emotional toll, the bond between pets and their people remains strong.

But love alone can't cover the cost of care. Addressing pet poverty will require broader access to affordable veterinary services, better education about pet insurance, and support systems that help families keep their pets healthy and at home.5

Methodology

This survey, conducted by Fractl on behalf of MetLife on June 5, 2025, examined 1,000 American pet owners' experiences to expose the growing crisis of pet poverty in the U.S. The average age of respondents was 41; 57% were female, 41% were male, and 2% were nonbinary. Generationally, 6% were baby boomers, 32% were Gen X, 46% were millennials, and 16% were Gen Z.

About MetLife Pet Insurance

MetLife Pet Insurance provides comprehensive insurance solutions for pets, offering pet owners financial security and peace of mind when it comes to veterinary care. Depending on your level of coverage and the plans you choose, we can cover everything from routine checkups to emergency services. Help your pets get the care they need and worry less about the costs.

Fair Use Statement

We invite you to share the findings from this article for noncommercial purposes. When doing so, please link back to MetLife Pet Insurance and provide proper attribution.