PET PLANNING

Have you ever been startled by an unexpected vet bill that strained your budget? If you find it tough to prepare for pet emergencies and veterinary needs, you're not alone. Many pet owners see their pets as family, but financial mindsets differ, with some ready to spend more than $2,000 on a visit and others not likely to spend over $300.

Our recent survey of 1,000 American pet owners examines their financial preparedness for unexpected veterinary emergencies. We reveal our findings below, including the challenges of budgeting for pet health and pet owners' financial strategies for handling these unexpected events.

Key takeaways

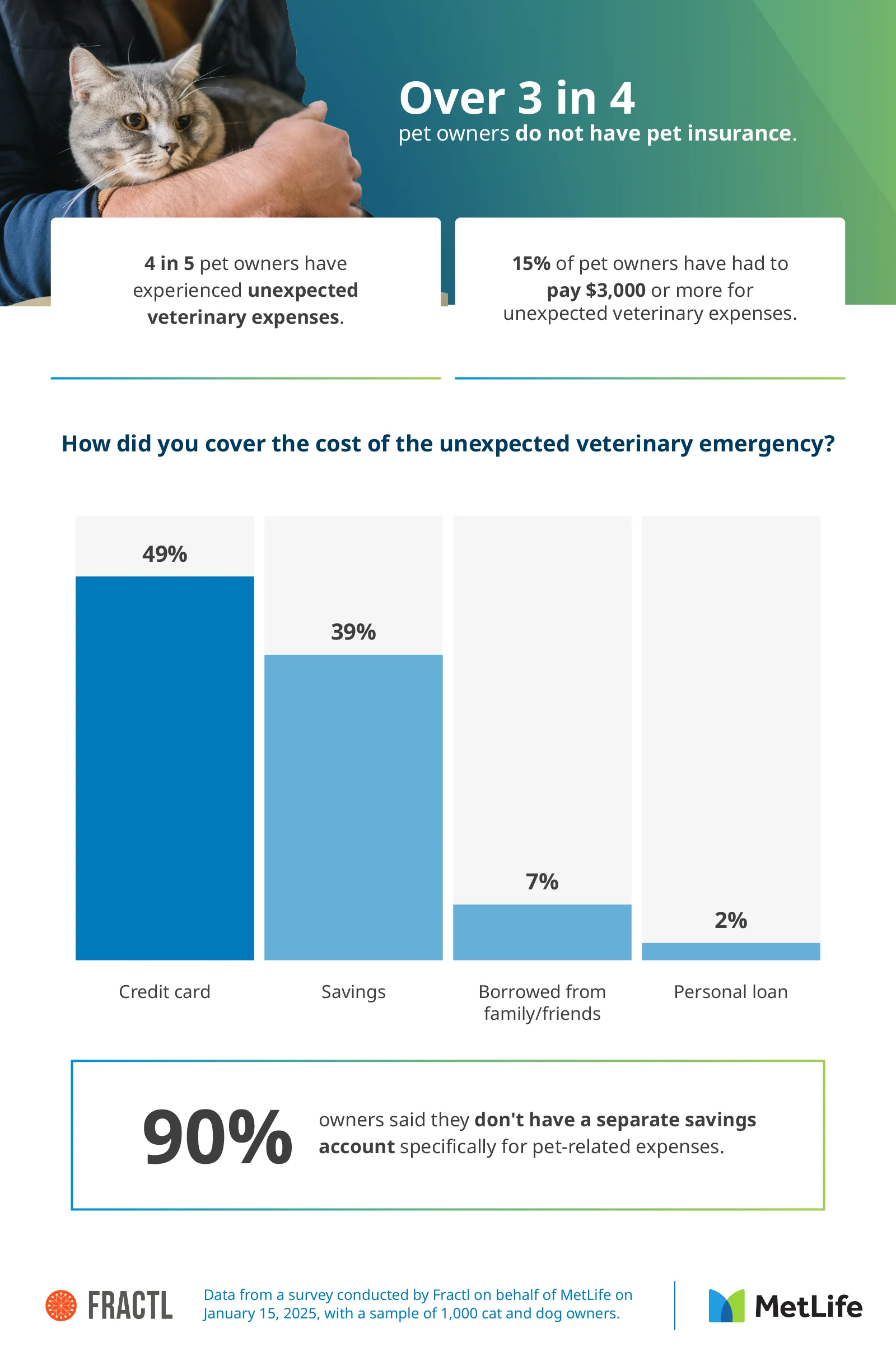

- Over 3 in 4 pet owners do not have pet insurance.

- 4 in 5 pet owners have experienced unexpected veterinary expenses, with the average cost being $1,100.

- Nearly 90% of pet owners lack a dedicated savings account for pet-related expenses.

- 7% of Americans are in pet-related debt, with an average balance of $2,200.

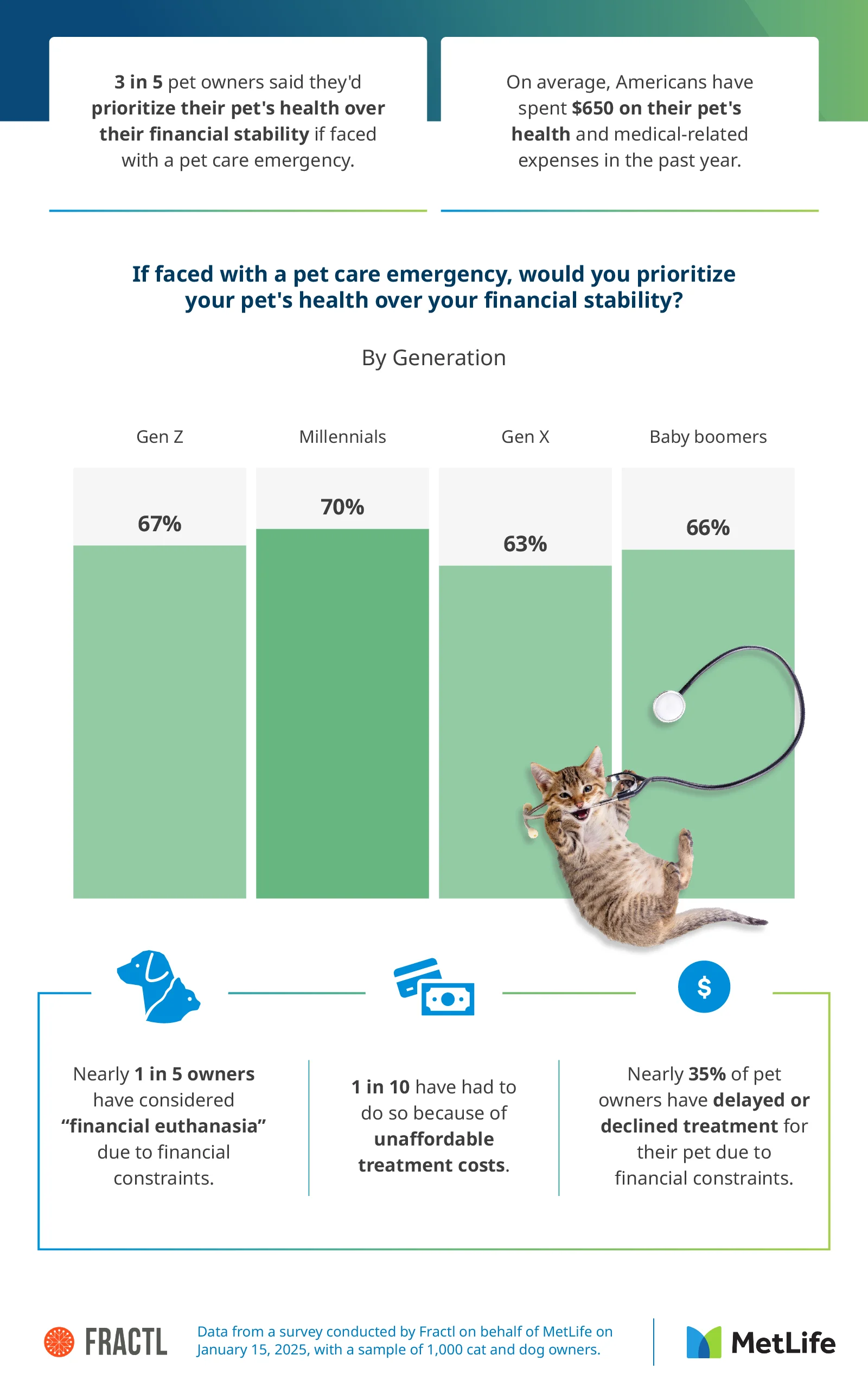

- 3 in 5 pet owners would prioritize their pet's health over their financial stability in an emergency.

- Nearly 1 in 5 pet owners has considered financial euthanasia—the difficult decision to euthanize a pet due to unaffordable medical costs—and 1 in 10 has had to proceed with it.

Pet Care's Financial Toll

Let's start with a look at how pet owners handle the costs of pet insurance and unexpected vet bills. We’ll then examine the generational differences in how Americans prepare for unplanned pet health issues and the challenges they create.

Over three-quarters of pet owners did not have pet insurance, showcasing a significant gap in financial preparation for pet health needs. Insurance coverage varied notably by generation, with 34% of Gen Z, 26% of millennials, 16% of Gen X, and 13% of baby boomers having it for their pets.

Does it make more sense to get health insurance for certain pets versus others? Owning a dog can cost up to $5,200 or more per year, while owning a cat could cost up to $2,800 or more annually.1,2 However, we found that dog owners were nearly twice as likely as cat owners to have secured pet insurance. Despite the annual cost difference, it can be worth it to insure both.

Unexpected veterinary costs are common, and it's important to be prepared. According to our survey, 4 in 5 pet owners have faced such expenses. The average cost of these unexpected expenses was $1,100, and the amounts varied by generation:

- Baby boomers: $950

- Gen X: $1,050

- Millennials: $1,100

- Gen Z: $900

However, 15% of pet owners have spent $3,000 or more on these unexpected veterinary costs. Gen Z may be catching onto the fact that it's a good idea to have a pet emergency fund: 15% of them had established a savings account specifically for pet-related expenses, and 44% had used savings to cover unexpected pet care expenses.

Unfortunately, most of the Americans we surveyed weren't ready for a pet emergency: 90% said they don't have a savings account dedicated to pet-related expenses.

Pet Owners' Toughest Choices

Next, we'll detail pet owners' regrets, priorities, and how cost influences their treatment decisions during veterinary emergencies.

Overall, 3 in 5 pet owners said they would prioritize their pet's health over their financial stability, including 70% of millennials, 67% of Gen Z, 66% of baby boomers, and 63% of Gen X. Still, 2 in 5 respondents expressed regret over not having gotten pet insurance in time for it to help pay for a veterinary emergency.

Americans' average annual expenditure for pet health and medical expenses was $650, but almost 1 in 10 Americans had spent $2,500 or more in the past year. Baby boomers spent an average of $500, Gen X and millennials each spent an average of $650, and Gen Z spent $600.

Financial pressures led many pet owners to make tough choices for their pets. Nearly 1 in 5 considered financial (economic) euthanasia — euthanasia due to not being able to afford a pet's medical care — because of cost constraints, and 1 in 10 had to proceed with it.

Over a third of pet owners (35%) delayed or declined treatment for their pets due to financial limitations, but it was more common among some generations than others: 41% of Gen X, 35% of millennials, 25% of baby boomers, and 22% of Gen Z.

It's clear that many Americans need help affording pet care. About a third of them (31%) said they support the idea of mandatory pet insurance to prevent financial euthanasia, highlighting a growing awareness of the issue.

Younger generations are increasingly prioritizing pet ownership over having children due to economic barriers.3 Owning a pet generally costs far less than raising a child — however, nearly 1 in 5 pet owners told us they wouldn't spend more than $300 on a single vet visit.

Although 2 in 5 were willing to spend over $2,000 at the vet, another 3 in 5 had not included vet expenses in their household budget. This gap spanned generations: 62% of baby boomers, 58% of millennials, 57% of Gen Z, and 46% of Gen X said they do not budget for these costs.

Not having the funds to cover surprise pet expenses could land pet owners in debt.4 About 7% of our respondents were in pet-related debt at the time of our survey, with an average balance of $2,200. Over 30% of pet owners also said they wouldn't be able to cover a $1,000 vet bill without help, especially younger generations: 39% of Gen Z and 35% of millennials, compared to 33% of Gen X and 22% of baby boomers.

Amidst all this financial strain and unpreparedness for unexpected pet-related expenses, most pet owners (almost 4 in 5) agreed that there should be more financial assistance programs to help pet owners afford pet care.

The True Cost of Pet Care

We've uncovered a mix of commitment and financial challenges among pet owners. Many were unprepared for high veterinary expenses, with gaps in financial planning and budgeting for pet care.

We also found a need for more financial assistance programs and concerning gaps in the number of Americans with pet insurance coverage.

Balancing the love for pets with financial realities is key to providing them with a good quality of life and offering their owners some financial peace of mind.Pet insurance offers a practical solution for helping pet owners manage unexpected veterinary costs.

Methodology

This survey, conducted by Fractl on behalf of MetLife on January 15, 2025, examined 1,000 American pet owners to assess their financial preparedness for unexpected veterinary emergencies. The average age of respondents was 43; 51% were female, 48% were male, and 1% were nonbinary. Generationally, 10% were baby boomers, 26% were Gen X, 52% were millennials, and 12% were Gen Z.

About MetLife

MetLife Pet Insurance provides comprehensive insurance solutions for pets, offering pet owners financial security and peace of mind when it comes to veterinary care. We can cover everything from routine check-ups to emergency services depending on your level of coverage and the plans you choose. Help your pets get the care they need and worry less about the costs.

Fair use statement

You may share this information for noncommercial purposes if you include a link back to our article.